The year 2023 is almost upon us in just a few days, and as the year’s end draws near, many Singaporean tax residents scramble to maximize their tax reliefs in the last few days of the year.

If you’re a Singaporean or foreigner looking for ways to reduce your tax burden, you can take advantage of several last-minute maximum tax reliefs. These income tax reliefs in 2022 in Singapore can help to lower your tax bill and provide some much-needed financial relief.

In this article, we will discuss the various tax reliefs available to Singaporean and foreign taxpayers, providing a comprehensive guide to ensure that you are taking advantage of every tax exemption available.

Taxable Income in Singapore

According to IRAS, “All income earned in or derived from Singapore is chargeable to income tax. Generally, overseas income received in Singapore is not taxable, except in some circumstances.”

Any individuals who are Singapore citizens, permanent residents in Singapore, and a foreigner working or staying in Singapore for more than 1832 are considered tax residents in Singapore.

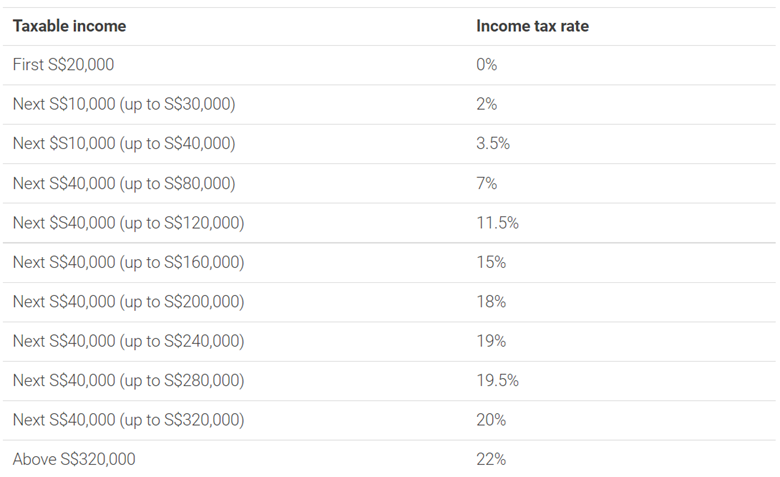

Income Tax Rates (slabs) for Residents and Foreigners

Recently IRAS has announced that the top marginal personal income tax rate will increase for Singapore residents who earn more than $500,000 annually beginning with the 2024 tax year.

If you want to learn more about which type of income is taxable or not taxable, you can visit IRAS’s guide to get more comprehensive information.

Best ways to reduce your personal income tax in Singapore

Various income tax reliefs are available to make filing taxes less stressful.

CPF Contributions

If you’re a taxpayer in Singapore, you may also be able to reduce your tax by using your Central Provident Fund (CPF) contributions. These contributions can offset your tax liability, providing some much-needed financial relief.

You need to make sure your CPF top-ups are to be completed by December 31, 2022.

When you top off your Special Account with CPF, up to $8,000 will be deducted from your chargeable income.

Moreover, by adding to your parents’ or grandparents’ CPF SA/RA, you can lower it by an additional $8,000 per year. However, any amount above the present Full Retirement Sum ($192,000 in 2022) is not tax deductible.

Donate to Charity

Making donations to approved charitable organizations can not only help those in need, but it can also help to reduce your tax burden. The IRAS offers tax relief for donations made to approved charitable organizations, so keep track of your donations for tax purposes.

You may deduct financial donations to eligible charities up to $300 ($600 for married couples filing jointly).

If you donate more than $300 ($600 if married filing jointly), you must itemize to claim the total amount.

Besides, IPC donations are eligible for a generous 250% tax deduction. In other words, if you donate $10,000, your chargeable income is reduced by 250% to $10,000, or $25,000. The deduction, though, is only put into effect the following year.

Be a Parent: Tax relief for Singapore parents.

If you have children, you may be eligible for several tax reliefs, including Qualifying Child Relief (QCR), Working Mother’s Child Relief (WMCR)*, Parenthood Tax Rebate (PTR), Foreign Domestic Worker’s Levy Relief*, Grandparents Caregiver Relief (GCR)*.

For each of these reliefs, there are different criteria for tax savings, so please refer to the IRAS page for complete information.

Study Hard: Course Fees Relief

IRAS offers taxpayers several personal reliefs, including course fees relief.

Upskilling helps us become more brilliant in our niche, but it is also costly as, most of the time, you have to pay to learn a particular course. At the same time, you are also eligible for tax relief up to a maximum amount of $5500.

According to IRAS, if you attended any course of study, seminar, or conference in 2021 for the purpose of obtaining an accepted academic, professional, or vocational* degree, you may claim Course Fees Relief for the Year of Assessment (YA) 2022.

Utilize Life Insurance Relief

Purchasing insurance can not only protect you and your loved ones in the event of an unexpected event, but it can also help to reduce your tax burden. By paying premiums for approved insurance policies, you can claim a tax relief on your premiums.

Important Note: The $5,000 cap on the total CPF contribution for YA 2023 onwards does not include the optional cash contribution you made to your Medisave account.

Make use of Earned Income Relief

Earned Income Relief is for the individuals who are gainfully employed or who are running a trade, company, profession, or vocation and are eligible for earned income relief.

If you have earned an income through employment, pension, or through trade, business and vocation, then you will receive the Earned Income Relief.

Individuals below 55 years old are eligible for a maximum amount claimable of $1000, while if you are between 55 to 60 years old, then you can claim up to $6000. Senior citizens aged 60 years and above can claim the maximum amount from this relief, up to $8000.

Tax relief Singapore for foreigners

If you are a foreigner working in Singapore, you may be eligible for tax relief on your employment income. Any foreigner who stays or works in Singapore for at least 183 days throughout a calendar year they are considered a tax resident. A foreigner is viewed as a non-tax resident if they stay in Singapore for less than 183 days.

Meanwhile, foreigners who are in Singapore for less than or equal to 60 days are exempt from paying taxes and are treated as non-residents by IRAS.

For tax residents, the above income tax reliefs are available as part of their tax exemption.

Conclusion

In conclusion, there are several tax reliefs and exemptions available to Singaporeans and foreigners living in the country. Taking advantage of these last-minute maximum tax reliefs can reduce your tax burden and keep more of your hard-earned money.

It’s important to carefully review the available options and consult with a tax professional to determine the best course of action for your specific situation.