What Is an Unsecured Personal Loan?

An unsecured personal loan is a type of loan you can take without offering any assets as a guarantee. This means you don’t need to put up your car, home, or savings to get approved. The lender trusts that you’ll repay the money based on your income, job stability, and credit score.

This is different from secured loans, where you must give a collateral as backup. If you don’t repay a secured loan, the lender can take your given asset as compensation. With unsecured loans, there’s no such risk to your belongings.

Best unsecured personal loans are fast, flexible, and easier to access for many people. You can use them for many things in Singapore. This includes paying off bills, covering emergency costs, or funding personal plans. Licensed moneylenders like Quick Loan offer this type of loan, fast and fuss-free.

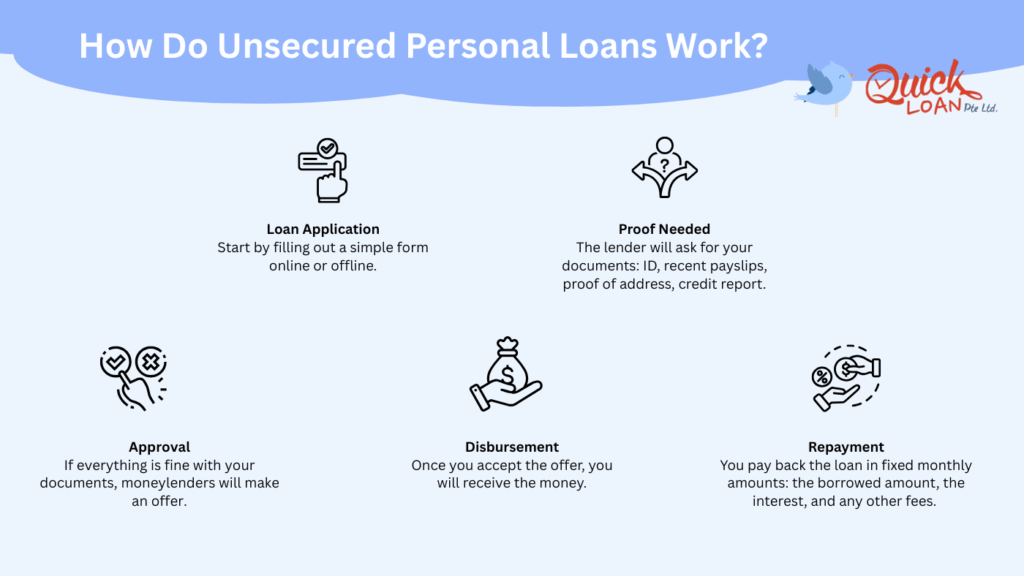

How Do Unsecured Personal Loans Work

- Loan Application: Start by filling out a simple form. You can do this online from home or visit the lender’s office if you prefer face-to-face help.

- Proof Needed: The lender will ask for your documents. These usually include your ID, recent payslips, and proof of address. Others may sometimes ask for your credit report too. They check these to make sure you’re able to repay the loan.

- Approval: If your documents are in order and you meet the personal loan requirements, the moneylender will invite you down to their store and make you a loan offer. On the spot, you can discuss with them the amount of personal loan you can get, the interest rate, and how long you have to repay.

- Disbursement: Once you accept the offer, you will receive the money. The lender will credit straight into your bank account or hand it to you in cash.

- Repayment: You pay back the loan in fixed monthly amounts. This includes the borrowed amount, the interest, and any other fees. You keep paying each month until the full amount is cleared.

Unsecured personal loans with interest rates are often processed faster than secured ones because they need no collateral. With licensed moneylenders like Quick Loan, approval can take as little as 20 minutes. This is ideal when you need cash quickly.

What Can You Use an Unsecured Personal Loan For

Unsecured personal loans are versatile. You might use one for:

- Merging various debts (like credit cards or other loans):

Combine your debts into one easy monthly payment with a single loan. - Paying for unexpected medical costs:

Use the loan to cover sudden hospital or clinic bills without delay. - Funding a honeymoon, vacation, or big trip:

Plan your dream holiday now and repay it in affordable steps. - Financing education or work-related courses:

Pay for school fees or training that helps boost your career. - Repairing home items or car expenses:

Fix broken appliances or car repairs without waiting for payday. - Covering daily essentials during tough times:

Get the support you need for groceries, bills, or rent when money is tight.

You generally won’t need permission on how you use your loan. Feel free to use the money for what matters to you.

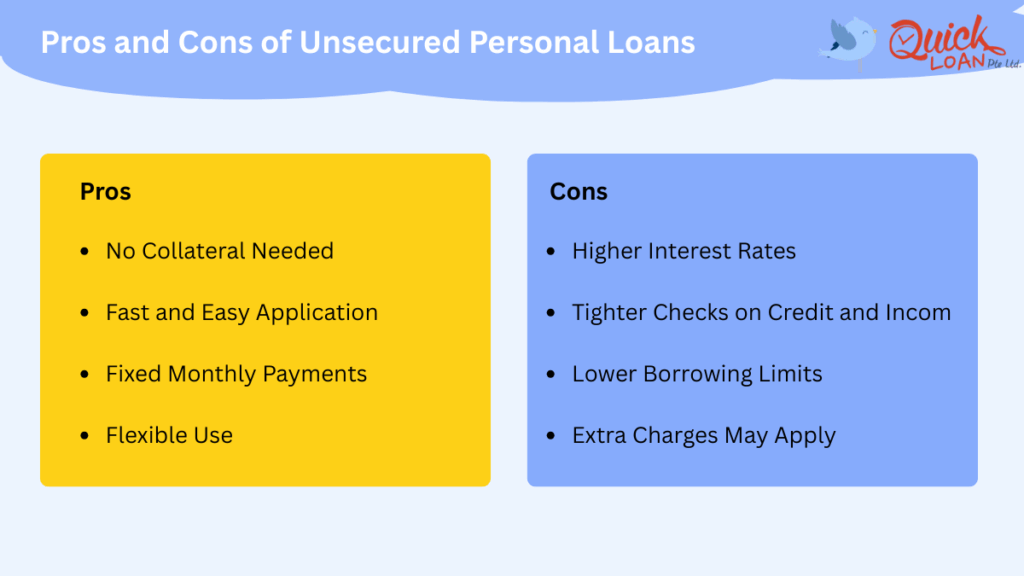

Pros and Cons of Unsecured Personal Loans

Applying an unsecured personal loan with interest rates can help handle urgent expenses. But like all financial products, it has upsides and downsides. Here’s a breakdown to help you decide if it’s right for you.

Pros of Unsecured Personal Loans

No Collateral Needed:

You don’t have to pledge your home, car, or other assets. This means you won’t lose anything valuable if things don’t go as planned.

Fast and Easy Application:

Since there’s no need to check or hold assets, approval is often quicker. With licensed lenders like Quick Loan, you can get your money on the same day.

Fixed Monthly Payments:

Know exactly what to pay back each month. This makes it easier to plan your spending and avoid surprises.

Flexible Use:

Whether you need to pay off other debts, cover medical bills, or fund a vacation, you can use the loan as you see fit. There are no restrictions.

Cons of Unsecured Personal Loans

Higher Interest Rates:

Since the loan isn’t backed by anything valuable, lenders may charge more as protection. This means you’ll pay more in total.

Tighter Checks on Credit and Income:

Lenders will look at your credit score, monthly income, and past repayments. If your history isn’t strong, approval may be harder.

Lower Borrowing Limits:

You may not be able to borrow as much as you could with a secured loan like a mortgage or car loan.

Extra Charges May Apply:

Some lenders add processing fees, late charges, or early repayment penalties. Always read the terms before you sign.

By weighing the pros and cons, you can decide if an unsecured personal loan is the right solution for your needs.

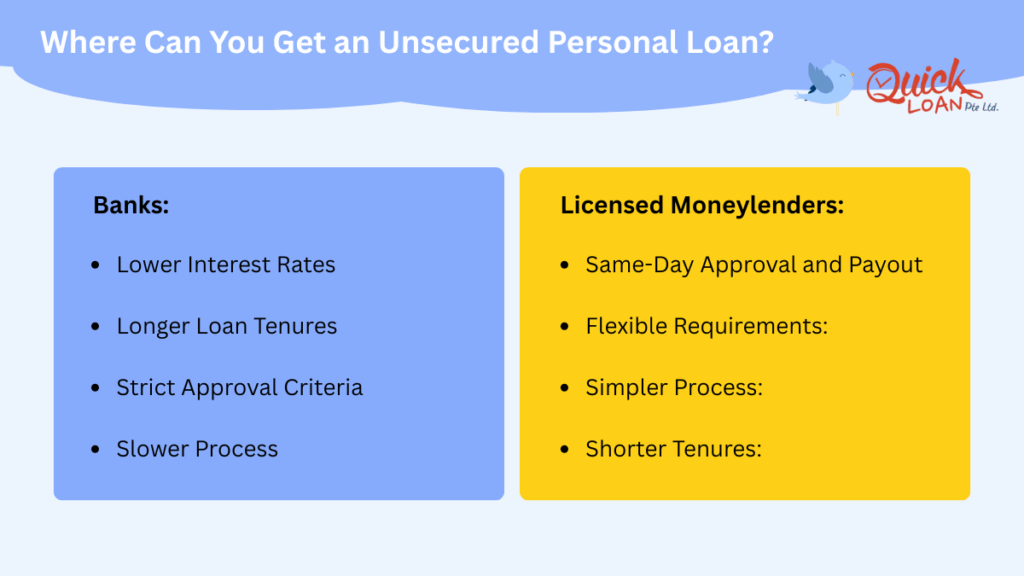

Where Can You Get an Unsecured Personal Loan

In Singapore, there are two main places you can turn to for an unsecured personal loan. These are banks and licensed moneylenders. Each has its own strengths, depending on your situation.

Banks

Banks are usually the go-to option for borrowers looking for long-term loans and low rates. Here’s what to expect:

- Lower Interest Rates:

Banks tend to offer some of the lowest rates if you qualify. - Longer Loan Tenures:

You can repay over a few years, which helps keep monthly payments low. - Strict Approval Criteria:

You’ll need to meet minimum income levels (usually S$20,000 to S$30,000 a year or more) and have a good credit score. - Slower Process:

Applications can take days or even weeks. This is due to stricter background checks and paperwork.

If you meet all the requirements, a bank may offer better rates. But if you don’t, getting approved could be difficult.

Licensed Moneylenders

Licensed moneylenders, like Quick Loan, are a trusted option for fast access to cash.

Here’s what makes them a popular choice:

- Same-Day Approval and Payout:

Applications are usually processed in under 30 minutes, with cash handed out the same day. - Flexible Requirements:

Lower income? New to a job? Moneylenders may still consider your application.

- Simpler Process:

Fewer documents, less waiting, and clear terms. Ideal for urgent or unexpected expenses. - Shorter Tenures:

Repayment plans are typically shorter, which means higher monthly instalments. But you clear the debt faster.

Licensed moneylenders are a practical, legal, and regulated solution. They serve as an alternative for borrowers who need quick access to money or don’t meet bank criteria.

How to Qualify for an Unsecured Personal Loan

Before you apply for an unsecured personal loan, it helps to know what lenders usually look for. Meeting these requirements boosts your chances of getting approved.

Age Requirement:

You must be an adult. Some lenders accept applications from those aged 18 and above. Others may require you to be at least 21.

Minimum Annual Income:

Most banks and financial institutions expect you to earn at least S$20,000 to S$30,000 a year. If you’re a foreigner, the bar is usually higher, some lenders may ask for S$40,000 or more.

For example, as a licensed moneylender, Quick Loan follows the regulations set by the Registry of Moneylenders. The table below provides an idea on how much we can lend our borrowers:

| Annual Income | Singaporeans & PRs | Foreigners |

| Below S$10,000 | Up to S$3,000 | Up to S$500 |

| S$10,000 – S$20,000 | Up to S$3,000 | Up to S$3,000 |

| Above S$20,000 | Up to 6x monthly income | Up to 6x monthly income |

Employment and Income Type

A steady job gives lenders confidence that you can repay. This usually would be a full-time role. Lenders also prefer borrowers who are regular freelancers or self-employed with consistent income. Some lenders may also consider CPF contributions as proof of employment.

Credit Score and Debts

Lenders check your credit score to see if you’ve been paying off other loans on time. If you have many unpaid debts, it may affect your approval. But a good repayment history works in your favour.

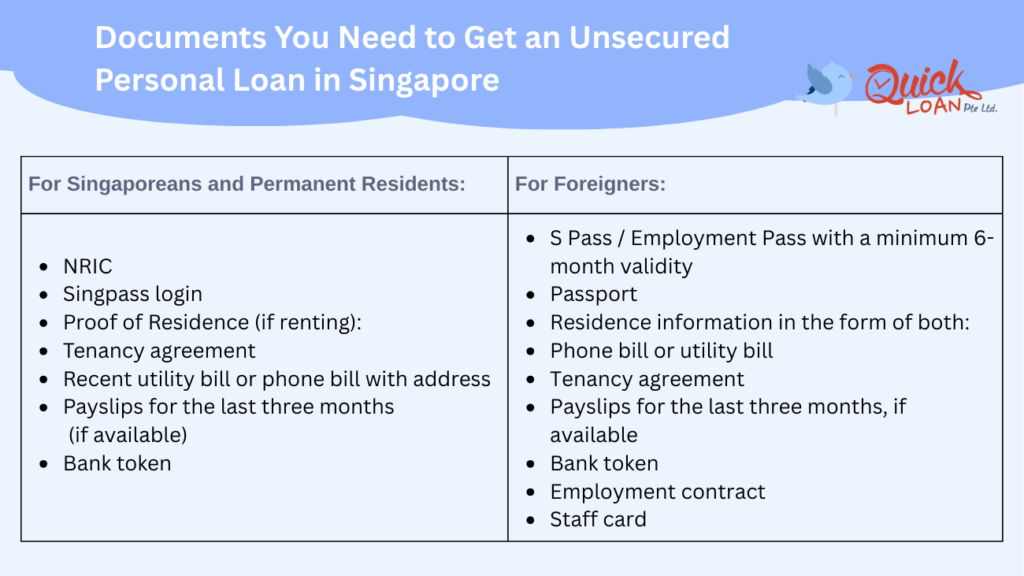

Required Documents

You’ll need to provide certain required documents, depending on your case and status:

- NRIC (front and back) (for Singaporeans and PRs)

- Passport and valid work pass (for foreigners):

- Employment Pass

- S Pass

- Recent payslips or income proof:

- CPF contribution statements

- Bank statements

- Income Tax Notice of Assessment (NOA))

- A copy of your employment contract (for foreigners)

- Proof of address (for foreigners):

- Utility or phone bill showing your name and local address

- Tenancy agreement

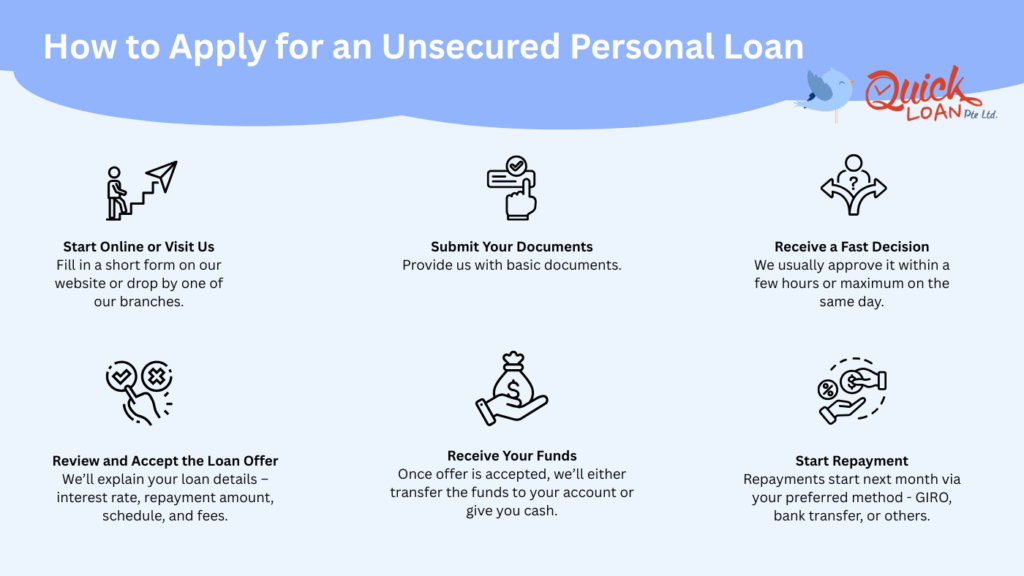

How to Apply for an Unsecured Personal Loan

Applying for an unsecured personal loan in Singapore isn’t as difficult as it sounds. Follow these simple steps to make the process smoother and more confident.

1. Check Your Credit Score

Start by finding out where you stand. Your credit score is a number that shows how well you’ve handled past loans or bills. You can get your credit report from the Credit Bureau Singapore (CBS).

A higher score usually means better chances of approval and lower interest rates. A lower score might still get you a loan, especially with licensed moneylenders, but with

2. Choose Your Lender

Look around and compare your options. Different lenders offer different:

- Interest rates

- Repayment periods

- Fees

- Loan amounts

Some borrowers may prefer banks. Others may approach licensed moneylenders like Quick Loan. The latter especially if they want quicker approvals or more flexibility.

💡 Tip: Always check if the lender is licensed under the Registry of Moneylenders

3. Get Pre-Approval (Optional but Helpful)

Some lenders offer pre-approval or loan calculators on their websites. This gives you a rough idea of how much you might qualify for and what your monthly payments could look like.

It’s not a guarantee, but it helps you plan better before committing.

4. Submit Your Application and Documents

Once you’ve picked a lender, you’ll need to fill out an application form. This can usually be done online, over the phone, or in person.

You’ll also need to upload or bring your documents. Common ones include:

- NRIC / Work Pass

- Payslips or income proof

- Bank statements

- Proof of address (utility or phone bill)

- Tenancy agreement (if renting)

5. Face-to-Face Verification (for Licensed Moneylenders)

Singapore law requires you to show up in person if applying with a licensed moneylender. This step ensures identity verification and adds transparency.

At this meeting, the loan officer will:

- Check your documents

- Explain the loan terms clearly

- Answer your questions

- Make sure you understand what you’re signing

6. Review and Sign the Loan Agreement

Don’t rush through this part!

Take time to read the loan contract, including:

- Interest rate

- Loan amount

- Repayment schedule

- Any fees (e.g., late payment fees, early repayment clauses)

Once you’re satisfied, sign the agreement and keep a copy.

7. Receive Your Funds

After signing, your loan will be disbursed. This can be done in cash or direct to your bank account, sometimes within the same day.

Conclusion

Unsecured personal loans can be a helpful solution when you need quick access to funds. It can help for medical bills, education, travel, or unexpected costs. If you’re also thinking about long-term goals like buying property, it’s worth knowing how taking a home loan after a personal loan could affect your borrowing options. Since they don’t require collateral, they offer more flexibility and faster approvals. This is especially true when working with licensed moneylenders like Quick Loan.

That said, it’s important to borrow wisely. Always compare your options and understand the loan terms. With that, choose an amount and lender that fits your budget. An unsecured loan can be a smart and manageable way to meet your financial needs.