How Many Personal Loans Can You Have at Once

The short answer is that there’s no official limit set in Singapore on how many personal loans you can take. You can apply to various lenders if banks or licensed moneylenders allow it.

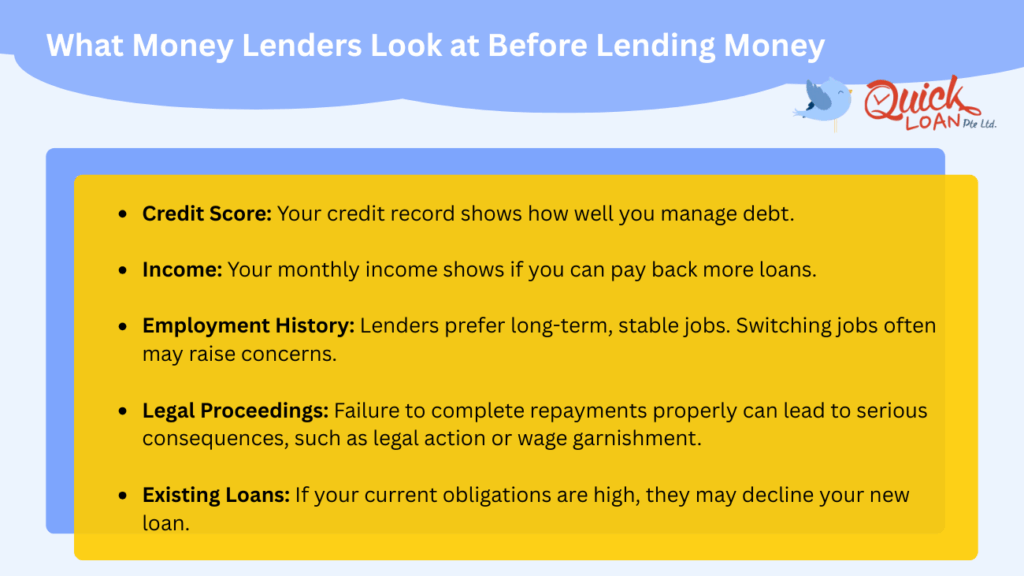

Still, getting approval depends on your situation. Here’s what lenders look at:

1. Credit Score

Your credit record shows how well you manage debt. A large number of loan applications can hurt your score. A good score boosts your chance of approval. A poor score can lead to rejection or higher interest.

2. Income

Your monthly income shows if you can pay back more loans. Lenders will check your payslips, income tax records, and CPF statements. This is to confirm that you’re earning enough to support added payments.

3. Employment History

Lenders prefer long-term, stable jobs. Whether you work full-time or freelance, they want to see income consistency. Switching jobs often may raise concerns.

4. Legal Proceedings

While taking multiple personal loans is legal in Singapore, your repayments are crucial. Failure to do so can lead to serious consequences, such as legal action or wage garnishment. Be sure to stay on top of payments or seek help early. This can prevent legal trouble and protect your credit record.

5. Existing Loans

If you already have personal, car, home, or other loans, lenders look at the monthly repayments. If your current obligations are high, they may decline your new loan.

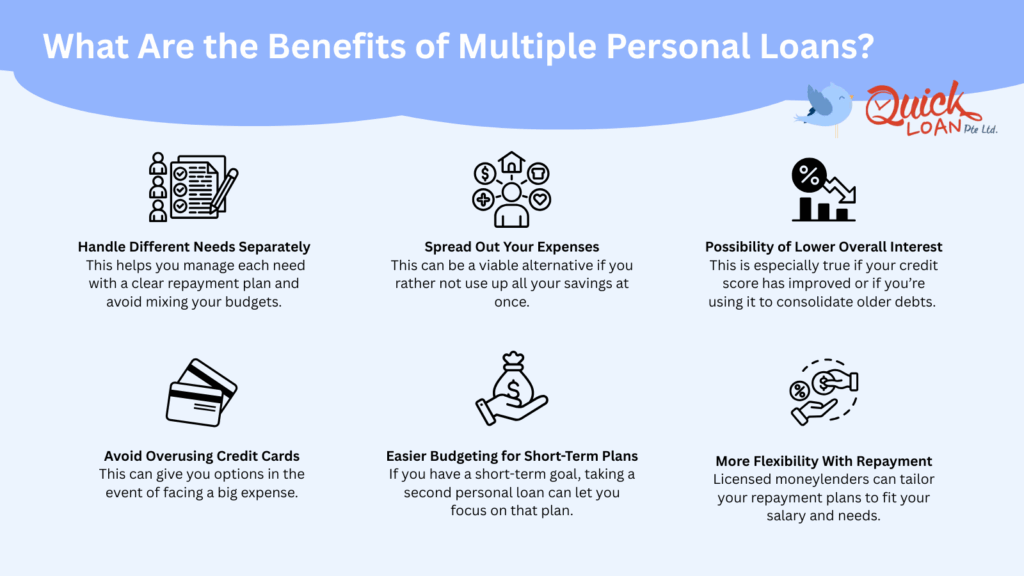

What Are the Benefits of Multiple Personal Loans

Having more than one personal loan isn’t always a bad thing. In fact, when planned, these loans can give you flexibility with your finances.

Here are some of the upsides to taking various personal loans, if done responsibly:

1. Handle Different Needs Separately

One of the main reasons people take more than one loan is to keep financial needs separate. For example, you might have one loan for home renovations. Another loan may be for urgent medical expenses. This helps you manage each need with a clear repayment plan and avoid mixing your budgets.

2. Spread Out Your Expenses

A second loan can help you spread out the cost of large purchases or unexpected bills. This allows you to keep some cash in hand while still covering what you need. This can be a viable alternative if you rather not use up all your savings at once.

3. Possibility of Lower Overall Interest

Sometimes, a new loan might come with a better interest rate. This is especially true if your credit score has improved or if you’re using it to consolidate older debts. With smart planning, this can reduce the total amount you pay in interest over time.

4. Avoid Overusing Credit Cards

Personal loans often come with lower interest rates compared to credit cards. Taking a second loan might be cheaper than maxing out your card and paying high monthly interest. This can give you options in the event of facing a big expense.

5. More Flexibility With Repayment

Some people take a second loan to get longer repayment terms or to reduce their monthly payment load. This works especially well when you use a licensed moneylender like Quick Loan. Such lenders can tailor your repayment plans to fit your salary and needs.

6. Easier Budgeting for Short-Term Plans

If you have a short-term goal, taking a second personal loan can let you focus on that plan. This gives you a way to pursue things like a professional course or a dream wedding. In return, these short-term plans will not disturb your long-term commitments. This includes expenses like mortgage or your education loan.

Of course, for how many personal loans you can take, this should only be done if you’re confident in managing it. With proper planning, it can be a useful tool, not a burden.

What Are the Risks of Multiple Personal Loans

It’s perfectly fine to take more than one personal loan, as long as you manage them well. Timely, full repayments are key. Juggling multiple loans without a clear plan can quickly stretch your budget.

That’s why it’s important to stay mindful of your financial limits and know the risks before taking on more debt. Here’s what you need to watch out for when wondering how many personal loans you can take:

1. Higher Monthly Repayments

Each loan you take adds to your monthly debt. Thus, adding another means even more money is leaving your bank account every month. If your income doesn’t go up too, it can be tough to keep up with all the payments. This is especially true when you’re already paying off a pre-existing loan.

2. Missed or Late Payments

When you juggle various loans, it’s easy to forget a due date or run short on cash. Missing even one payment can hurt your credit score and lead to penalty fees. Over time, late payments also make it harder to get future loans or better interest rates.

3. Debt Can Grow Quickly

Personal loans come with interest. The more loans you have, the more interest you’ll owe. If you take too many loans without a plan, your debt can grow faster than you expect. This can trap you in a cycle where you borrow more to repay existing loans.

4. Possible Damage to Your Credit Score If You Fail to Pay on Time

Your credit score shows how well you manage your debts. If you apply for too many loans in a short time or start missing payments, your score can drop. A lower score makes lenders see you as a risky borrower, and it may be harder to get approved in the future.

5. More Things to Manage

Having multiple personal loans means keeping track of several repayment schedules. This includes their due dates, and terms. It adds to your monthly responsibilities and requires more attention to budgeting. Staying organised becomes essential to avoid missed payments or extra charges.

Borrowing more than once is not always bad, but it comes with added responsibilities. Make sure you’ve thought through how it will affect your budget. This can help you plan in detail before you apply for another personal loan.

What to Consider Before Getting Multiple Personal Loans

Before applying for another loan, it’s important to take a step back and do a little bit of research and planning. Taking on multiple personal loans isn’t just about getting approved. This also includes managing your finances well after the money comes in.

Here’s what to think about:

1. Your Monthly Repayment Capacity

Look at your take-home income and compare it with your existing obligations. Ask yourself if adding another repayment will stretch your budget too thin. If you’re unsure, it helps to first check how much personal loan you can get in Singapore based on your income and credit profile. It’s not just about being able to pay. This should mean that you are paying comfortably without sacrificing essentials.

💡 Tip: you can use this free budget planner by MSF to check if your loans still leaves enough for your daily needs.

2. Compare Loan Terms Carefully

Different lenders have their own loan terms, so don’t just look at the monthly instalment. Check for early repayment penalties and late payment fees. Also, be sure of the due dates, flexibility in repayment, and the minimum monthly amount. Even small differences in these details can make a big impact on how much you end up paying overall.

3. Have a Clear Reason for the Loan

Before you apply, make sure you have a clear purpose and a repayment plan. Avoid taking a loan “just in case” – this can lead to unnecessary debt and poor spending habits.

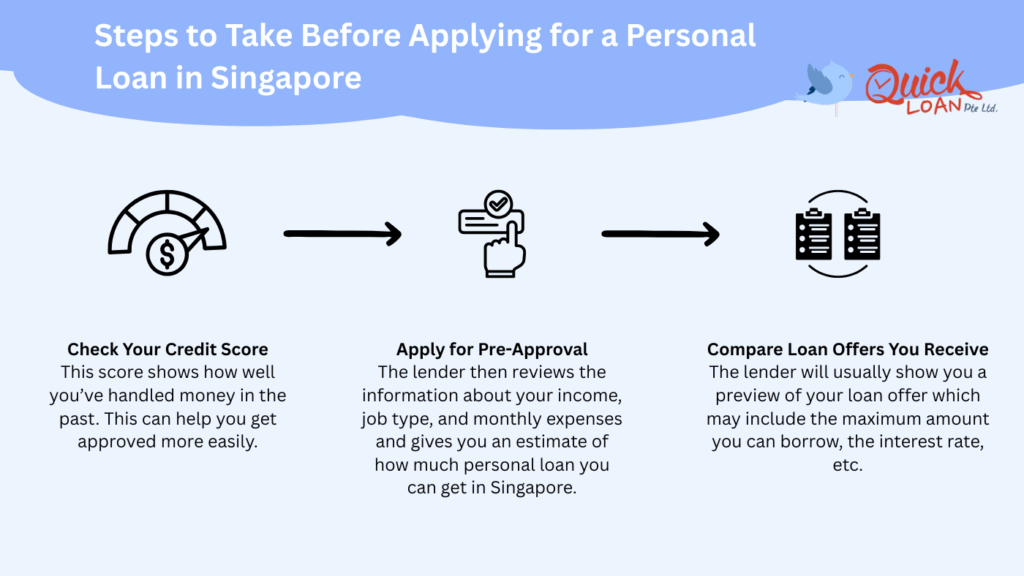

4. Check Your Credit Score First

Your credit score reflects your reliability as a borrower. A lower score could mean higher interest rates or even loan rejection. Before applying, be sure to check your score through Credit Bureau Singapore (CBS).

5. Fix A Repayment Due Date for Multiple Loans

When applying for more than one loan, try to take them around the same time, such as the 15th or 16th of the month. This helps ensure that your monthly repayment dates line up, making it easier to manage. It’s also smart to borrow shortly after your payday. This way, you’ll always have fresh funds to handle installments promptly.

How to Manage Multiple Personal Loans

If you’re juggling more than one personal loan, good management is essential. This is true, no matter how many personal loans you can take.

Without a solid plan, you could find yourself overwhelmed by payment dates. This can also include extra interest charges, and mounting stress. But with a bit of structure, staying on track is very possible – even with several loans.

Here are some simple, practical strategies to help:

1. Automate Your Repayments

Set up GIRO or automatic payments from your bank account for all your loans. This reduces the chance of forgetting a due date and avoids late fees. It also helps keep your credit record clean, which is important for future borrowing.

💡 Tip: Schedule your repayments right after payday to ensure you have enough funds.

2. Keep a Clear Payment Schedule

Use a calendar or mobile app to track due dates. Note the amount, date, and lender. Having all your loans in one place helps you stay organised and avoid surprises. You’ll always know what’s due and when.

3. Prioritise Higher-Interest Loans

If you can afford to make extra payments, focus on clearing the loan with the highest interest rate first. This is known as the avalanche method and helps you save more money in the long run.

Otherwise, the snowball method focuses on paying off the smallest loan first. This helps to build momentum and confidence. Choose the method that motivates you best.

4. Create a Monthly Budget

List your income and expenses clearly. Set aside funds for all your loan repayments before spending on anything else. If you find yourself short on cash, look for areas to cut back until your loans are under control. This includes subscriptions or luxury spending.

5. Avoid Taking On More Debt

While managing existing loans, try not to take on more borrowing payments. This includes new credit cards or “buy now, pay later” schemes. These can add up quickly and stretch your finances even thinner.

6. Set Reminders for Annual Reviews

Once a year, review your financial situation. Check how much debt you still owe. Also, whether your income has changed, and if you can adjust your repayment strategy. Staying proactive helps you stay in control.

How to Qualify for Another Personal Loan

If you’re already repaying one personal loan but need another, approval isn’t guaranteed. Lenders will want to know you can handle the added debt, which is why it’s important to learn how to apply for personal loans in Singapore properly to avoid rejection or delays. The good news? With the right steps, it’s possible to qualify!

Here’s what most lenders check, and how you can boost your chances:

1. Maintain a Strong Credit Score

Your credit score shows how reliable you are with repayments. A higher score usually means better chances of getting another loan. Always pay your current loans on time. This includes avoiding missed payments, and limiting new credit applications.

📌 Tip: You can check your credit score in Singapore through Credit Bureau Singapore (CBS).

2. Show Stable Income

Lenders want to know you can repay what you borrow. You will have to provide clear proof of steady income. This includes salaried workers, self-employed, or freelancers. The proof can be in the form of payslips, CPF statements, or bank account records.

💡 Tip: If your income has increased since your last loan, that can work in your favour.

3. Keep Your Debt Manageable Compared to Your Income

Lenders often look at how much of your monthly income goes to loan repayments. If a big portion of your pay is tied up in existing debts, this will catch their notice. In turn, this may reduce your chances of getting approved for another loan. Aim to keep your total monthly debt payments well within your income level.

4. Pay Existing Loans and Credit Cards on Time

Showing a strong repayment history helps build trust with lenders. When you pay your current loans and credit card bills on time, it signals that you’re reliable. This, in turn, will make them more likely to approve your next loan. Even small, consistent payments go a long way in improving your chances.

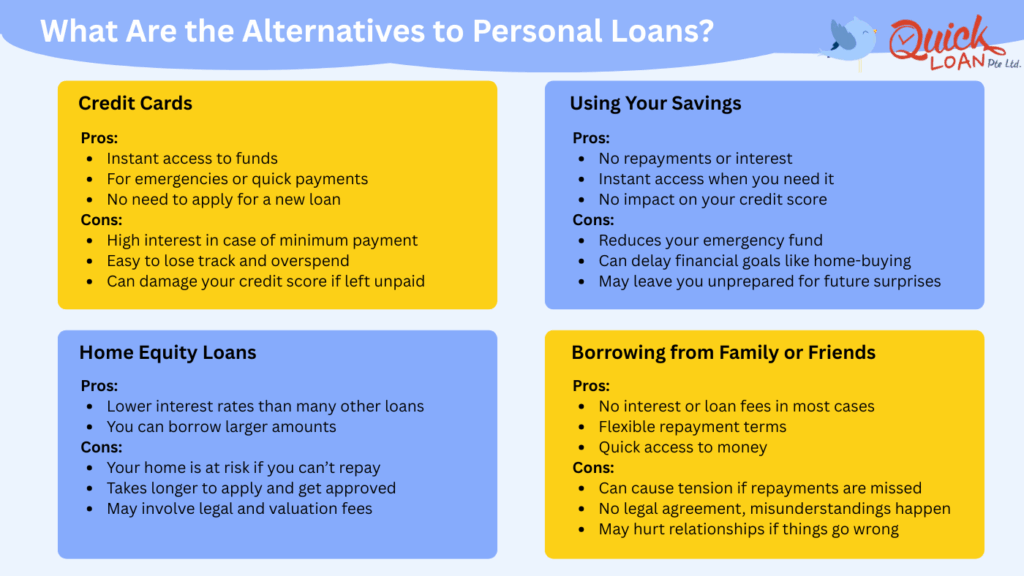

Alternatives to Multiple Personal Loans

Taking out more than one personal loan isn’t always the best move. It’s only natural to feel stretched or unsure about handling more debt. Here are some other options to consider:

1. Debt Consolidation Loans

A debt consolidation loan lets you combine all your existing debts into one. You make a single monthly payment which makes it easier to keep track and stay on top of your repayments. This usually incurs at a lower interest rate.

2. Balance Transfer

If most of your debt is on a credit card, transferring the balance to a new card with a 0% introductory rate can help. Often lasting 3, 6, or even 12 months, this gives you the breathing space to pay debts without heavy interest. For example, Standard Chartered and OCBC offer 12-month 0% deals with processing fees around 0.9% – 1.68%

📌 Tip: But be sure to repay within the promo period or late charges will apply.

3. Tap into Emergency Savings

Using some of your savings to cover urgent expenses might be better than borrowing again. You won’t owe any interest, and you avoid taking on more debt. This is, of course, if you have ample savings set aside.

⚠️ Tip: Only dip into savings if it won’t leave you financially exposed.

4. Borrow from Family or Friends

This option may come with no interest and flexible terms. But it’s important to treat it like any other loan, despite the relationship with the lender. Discuss repayment plans clearly to avoid straining relationships.

5. Talk to a Credit Counsellor

If you’re feeling overwhelmed, don’t wait. Credit Counselling Singapore (CCS) offers support for people struggling with debt. They can help you work out a realistic repayment plan.

Conclusion

Now you know: there’s no limit to how many personal loans you can take at once. But lenders will only approve based on your ability to repay them. Too many loans can hurt your finances, you may lose money on fees or strain your budget.

Instead of rushing, think very carefully. Borrow for real needs not lifestyle wants. Set automatic payments. Track everything. Use smart repayment methods.

With a little bit of planning and research, taking more than one personal loan can work to your advantage. If you’re also thinking about long-term goals like buying property, it’s worth knowing if you can take a home loan after a personal loan in Singapore. As long as you borrow within your means, a few personal loans can be part of a sound financial strategy!