What Is a Personal Loan

First things first: what is a personal loan?

A personal loan is a type of loan where you can borrow a lump sum of money without needing to offer anything in return.

Personal loans usually fall under “unsecured” loans. “Unsecured” means you don’t have to provide any collateral, like your home or car, as a form of deposit to the lender.

In Singapore, you can get personal loans from a few places. Banks, financial institutions, or licensed moneylenders.

How Personal Loan Works

To understand how a personal loan works, it helps to know what affects your chances of getting one. A personal loan starts with an application process. You are required to submit essential documents for the approval process to start. Approval usually depends on a few things. Your credit score, your income, and whether you can afford to repay the loan. Once approved, you will receive a significant amount of money, depending on the amount of loan approved.

When you make repayments for a personal loan, you repay not only the principal amount but also the interest and other applicable fees. The entire amount needs to be paid within the agreed timeline. This period can range from a few months to several years, depending on the loan amount and the lender, among other factors.

How to Use a Personal Loan

One of the biggest advantages of a personal loan is flexibility. Most lenders, including Quick Loan, allow you to use the loan amount for almost any purpose. For example, some common uses include:

- Medical Emergencies

When sudden illnesses or accidents happen, we worry whether we can afford treatment. Personal loans can give you quick cash for hospital stays, surgeries, or treatments. This ensures you and your loved ones can focus fully on recovery – not bills.

- Home Renovations

Home improvements can be costly. Whether you’re updating your new BTO flat or fixing a burst pipe in the toilet, expenses can add up quickly. A personal loan can help you build the safe and cosy home you want. Plus, you won’t have to drain your emergency savings.

- Weddings

Your big day should be memorable. But in Singapore, wedding costs can rise quickly. A personal loan can help you pay for your dream wedding. It covers costs like the venue and a professional photographer. This way, you can celebrate without worrying about money.

- Education

Investing in education for yourself or your child can create many opportunities. However, it often involves high tuition and living costs. A personal loan can help cover the difference between scholarships, savings, and costs. It makes it easier for you or a loved one to achieve academic dreams without added stress.

- Travel

Everyone deserves to explore the world, relax, and recharge. But big trips may seem impossible with a tight budget. A personal loan can make your dream vacation possible. It can help with a family holiday or a solo adventure. You won’t have to give up everyday needs.

- Consolidating Debt

Juggling multiple credit card payments each month? Tip: You can use a personal loan to combine your debts. This means one monthly payment, usually at a lower interest rate! This can help you save money and make your finances simpler. It also lowers the chance of missed payments.

With a personal loan, you usually have the freedom to use the money as you wish. Lenders seldom limit how you can spend it.

How Much Personal Loan Can You Borrow in Singapore

How much personal loan you can borrow in Singapore mostly depends on your yearly income and credit profile. Here’s a breakdown of borrowing limits based on income for both licensed moneylenders and banks:

Licensed Moneylenders – Loan Limits

| Annual Income | Singaporeans & PRs | Foreigners |

| Below S$10,000 | Up to S$3,000 | Up to S$500 |

| S$10,000 – S$20,000 | Up to S$3,000 | Up to S$3,000 |

| Above S$20,000 | Up to 6x monthly income | Up to 6x monthly income |

Licensed moneylenders in Singapore must stick to strict borrowing limits set by the Registry of Moneylenders. They might provide more flexible options for people who can’t qualify at banks. This includes gig workers and self-employed individuals.

Banks – Loan Limits (General Guideline)

| Annual Income | How Much You Can Borrow (Banks) |

| Below S$20,000 | Generally not eligible for personal loans* |

| S$20,000 – S$30,000 | Up to 2x your monthly income |

| Above S$30,000 | Up to 4 to 6x your monthly income |

*Some banks, like DBS, usually give loans only to Singaporeans, PRs, or certain foreigners who earn at least S$20,000 a year. Otherwise, foreigners usually need to earn more (around S$40,000 – S$60,000/year) to qualify.

Besides these guidelines, lenders may also assess:

- Credit score: Your credit score shows how well you repay debts and manage credit. A higher score tells lenders you are trustworthy and will likely repay loans on time.

- Current debt obligations: Lenders will review your existing monthly repayments to check if you’re already stretched. This includes credit cards, car loans, or other personal loans. If a large portion of your income is going to debt, they may reduce the amount they’re willing to lend.

- Employment stability: Lenders like borrowers who have steady jobs and regular income. This consistency reduces the chance of missed repayments.

- Other financial commitments: Big loans like mortgages or car financing cut down your income for new debts. Lenders consider this when deciding how much more you can borrow.

At Quick Loan, we look at each case quickly and separately. This way, you get a loan amount that fits your needs.

What Are the Eligibility Criteria for Personal Loans in Singapore

To apply for a personal loan in Singapore, you usually need to meet these basic personal loan requirements:

For Singapore Citizens and Permanent Residents:

- Minimum age: You must be at least 18 years old to apply for a personal loan. This makes sure that borrowers are adults and can handle a loan on their own.

- Minimum annual income: Most lenders require a minimum annual income of S$30,000. Some lenders, like licensed moneylenders, may give loans to people who earn less. They just need to pass other risk and affordability checks.

For Foreigners Working in Singapore:

- Minimum age: At least 18 years old

- Valid Employment Pass (EP) or S Pass

- Minimum annual income: Foreigners usually need a higher income, often between S$40,000 and S$60,000 a year. This amount varies based on the lender’s policies. This helps foreigners manage their loan repayments easily while living and working in Singapore.

Other Factors That May Be Considered:

- Employment history: Steady jobs help. If you’ve worked in your current position for 6 to 12 months, your chances of getting a loan approved are better.

- Length of stay in Singapore: Lenders usually favor foreigners who have lived in Singapore for some time. This indicates a stronger financial presence.

- Proof of residence: You usually need documents like tenancy agreements or utility bills to show your local address. This helps the lender contact you if necessary.

How to Apply for a Personal Loan in Singapore

Getting a personal loan in Singapore is pretty straightforward. However, your experience may differ based on whether you choose a traditional bank or a licensed moneylender.

Licensed moneylenders like Quick Loan offer faster approvals and flexible criteria. They offer personalized service. This differs from banks. They often have stricter credit checks and take longer to process.

The process for applying for a personal loan in Singapore is the same for both choices. Here’s a step-by-step guide to help you understand how a personal loan works during the application process:

How to Apply for a Personal Loan with a Licensed Moneylender (Step-by-Step)

Applying with a licensed moneylender like Quick Loan is fast, easy, and can be done online or in-person. Here’s how:

Step 1: Check if You’re Eligible

Make sure you meet the basic requirements:

- At least 18 years old.

- A steady income (we accept salaried employees, self-employed, and foreigners)

- Valid NRIC for locals, or passport + valid work pass for foreigners

Certain licensed moneylenders offer support for those who may not qualify at banks, on a case-by-case basis.

Step 2: Get Your Documents Ready

Licensed moneylenders usually require basic documents to review an application. Having these ready speeds up approval:

- NRIC (front and back) or passport and work pass

- Proof of income, like payslips or bank records

- Proof of address, such as a utility bill or tenancy agreement

Step 3: Apply Online or Visit Us

Most licensed moneylenders, like Quick Loan, allow their borrowers to easily apply online on their website.

They may also visit their physical branches for personal assistance.

Step 4: Get Fast Approval

The licensed moneylenders will review your application and documents. In most cases, you’ll get approval within hours, and the loan can be disbursed on the same day.

Step 5: Review and Accept the Loan Offer

For most licensed moneylenders, like Quick Loan – the interest rate, repayment amount, loan term, and any fees. There are usually no hidden charges, and you’ll know exactly what to expect.

How to Apply for a Personal Loan from a Bank (Step-by-Step)

Applying through a bank may take a bit more time and stricter checks. Here’s what the process usually looks like:

Step 1: Check Eligibility Criteria

Each bank has different rules. Most require:

- You to be 21 years or older

- A minimum annual income of around S$20,000 (higher for foreigners)

- A good credit score and stable employment

Step 2: Prepare Your Documents

For banks, they are more stringent on official documents for personal loans:

- NRIC (or passport + work pass for foreigners)

- Latest Income Tax Notice of Assessment (NOA)

- Payslips from the last 3 months or CPF contribution history

- Proof of address (like a utility bill or phone bill)

Banks often ask you to log in using Singpass to auto-fill some information.

Step 3: Apply via Bank Website or Mobile App

Visit the bank’s website or mobile app and follow their online application steps. Some banks allow applications through Singpass MyInfo, which speeds things up.

Step 4: Wait for Loan Approval

Approval may take 1 – 5 working days, depending on the bank.

Banks also conduct credit checks and may request more documents during this stage.

Step 5: Review Terms and Accept Loan

Once approved, review the loan details (interest rate, tenure, fees). Make sure you understand the Effective Interest Rate (EIR), which reflects the true cost of the loan.

After accepting, funds will be transferred to your account – usually within 1 – 3 days.

Compare Lenders Thoughtfully

While it may be tempting sometimes, always remember that it’s wise not to just jump at the first loan offer. Take time to compare different lenders based on:

- Interest rates: Certain lenders may charge interest rates differently, with some preferring a more fixed, consistent monthly rate, while others offer flexibility by calculating your monthly interest rates based on your remaining outstanding principal balance.

- Processing or admin fees: These are one-time charges from lenders. They cover the costs of handling your loan application and disbursal. It’s crucial to clarify these fees upfront. This way, you can avoid any surprises later.

- Repayment flexibility: Some lenders let you customize your repayment plan. You can choose a longer term to lower your monthly payment or a shorter term to save on interest. This flexibility helps ensure that your loan fits comfortably within your monthly budget.

- Customer support and reviews: Good lenders offer clear guidance and quick help. They are there for you when you need support or face repayment issues. Look at online reviews and testimonials. They show how a lender treats customers. This can help you decide before you commit.

Make sure your lender, like Quick Loan, is licensed by the Registry of Moneylenders. This way, you can trust the money provider. This will help you avoid falling for loan sharks pretending to be a real business.

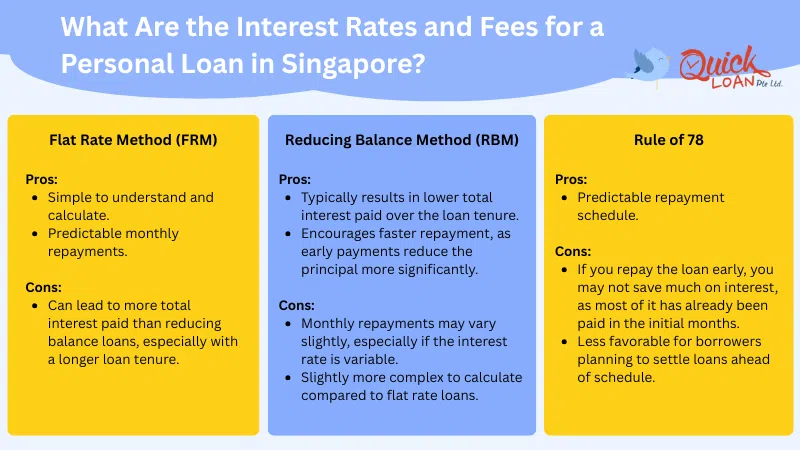

What Are the Interest Rates and Fees for a Personal Loan in Singapore?

Understanding how personal loan interest works is essential before committing. In Singapore, interest rates are typically structured in a few ways:

- Flat Rate Method (FRM)

Under the Flat Rate Method, you calculate interest on the original principal for the whole loan period. This means that even as you repay the loan, the interest charged each month remains constant.

Example: If you borrow S$10,000 at a flat interest rate of 5% per year for 2 years, you will pay S$1,000 in total interest. This is calculated as S$10,000 × 5% × 2. This interest is then divided equally over the loan tenure.

Pros:

- Simple to understand and calculate.

- Predictable monthly repayments.

Cons:

- Can lead to more total interest paid than reducing balance loans, especially with a longer loan tenure.

- Reducing Balance Method (RBM)

The Reducing Balance Method calculates interest on the remaining loan balance. This balance goes down as you make repayments. So, the interest part of each monthly payment goes down over time, and the principal part goes up.

Some licensed moneylenders, like Quick Loan, use RBM for their loans. This is often preferred by borrowers over others, as it rewards timely repayment. So long as the monthly payments are made, the interest owed will go down significantly as well.

Example: For a S$10,000 loan at a 5% reducing interest rate per year, the first month’s interest is based on the full S$10,000. As you repay the loan, the balance goes down. This also reduces the interest charged in the following months.

Pros:

- Typically results in lower total interest paid over the loan tenure.

- Encourages faster repayment, as early payments reduce the principal more significantly.

Cons:

- Monthly repayments may vary slightly, especially if the interest rate is variable.

- Slightly more complex to calculate compared to flat rate loans.

- Rule of 78

The Rule of 78 is different from the RBM. It front-loads interest payments. This means you pay more interest in the early months of the loan. It’s based on a weighting system. Each month’s interest is a fraction of the total months.

Example: For a 12-month loan, the sum of the digits from 1 to 12 equals 78. The first month’s interest would be 12/78 of the total interest, the second month’s interest would be 11/78, and so on.

Pros:

- Predictable repayment schedule.

Cons:

- If you repay the loan early, you may not save much on interest, as most of it has already been paid in the initial months.

- Less favorable for borrowers planning to settle loans ahead of schedule.

Also, check the fees, charges, and terms that come with a personal loan, along with the interest rates:

- Processing or Admin Fees: These are one-time charges from lenders. They cover the costs of handling your loan application and disbursing funds.

- Late Payment Charges: Fees imposed when a repayment is missed or delayed. These can be a set amount or a percentage of the overdue sum. However, they cannot go over $60 for each month you are late in repaying.

- Early Repayment Penalties: Some lenders charge a fee for early repayment. So, check this clause if you plan to pay off your loan early. Others, like Quick Loan, offer no early settlement penalties. They also allow borrowers to repay more than their instalment every month. This will, in turn, reduce their outstanding principal balance.

- Effective Interest Rate (EIR): The Effective Interest Rate shows the true cost of a loan. It includes the advertised interest rate. It also has extra fees, processing charges, and the repayment schedule.

The EIR is often higher than the advertised rate. It gives a clearer view of the total borrowing cost.

How Does Paying Back a Personal Loan Work in Singapore

You usually repay a personal loan in fixed monthly payments. These payments include the principal, the amount you borrowed, and the interest. Borrowers make these payments regularly over a set time agreed upon when they get the loan. This makes it easier for them to plan their finances.

Here are the key terms you should know:

- Tenure

The loan tenure refers to how long you’ll take to repay the loan in full. In Singapore, personal loan tenures can range from 1 month to several years.

- Monthly Repayment Amount

Your monthly repayment depends on a few things: the loan amount, the interest rate, and how long your loan lasts.

A shorter loan term lets you pay it off faster and reduces total interest. However, your monthly payments will be higher. A longer tenure lowers your monthly payments, but you’ll end up paying more interest over time.

Choosing the right tenure depends on your budget and how much you can repay each month.

- Repayment Method

Most lenders offer multiple repayment options for convenience, including:

- GIRO (automatic deduction from your bank account)

- Bank transfer or PayNow

Automated tools like GIRO lower the chance of missing due dates and facing penalties.

How a Personal Loan Works with Quick Loan

At Quick Loan, we believe borrowing money shouldn’t be complicated or intimidating. We designed our personal loan service to be fast, fair, and flexible. It’s perfect for emergencies or planning life’s big moments.

Flexible Loan Terms Designed for You

When you take a personal loan with Quick Loan, you’ll enjoy terms that are designed to work for you, not against you:

- Loan Amounts for Your Needs: Need S$1,000 for an urgent cost? Or maybe you want up to 6x your monthly income for something big? We offer loan amounts based on your income and financial needs, not just your credit score.

- Choose your repayment period: Select shorter terms to pay off your loan quickly, or opt for longer ones, for lower monthly payments. We’ll help you find a plan that aligns with your budget and lifestyle.

- Clear Rates and Fees: We offer simple pricing and clearly state all fees from the start. There are no hidden charges, no fine print tricks, and no stress.

- Open to Locals and Foreigners: We welcome Singaporeans, PRs, and foreigners on Employment or S Pass. Our team is ready to help you find a loan that fits your needs and meets your eligibility and documentation.

Simple and Fast Application Process

Quick Loan makes getting a personal loan easy. You fill out fewer forms. You get faster responses. Plus, you receive personal service at every step.

Here’s how personal loan applications work at Quick Loan:

- Start Online or Visit Us In-Person

Fill in a short form on our website or drop by one of our branches – whichever is more convenient for you. Our application process is quick, taking just a few minutes to complete.

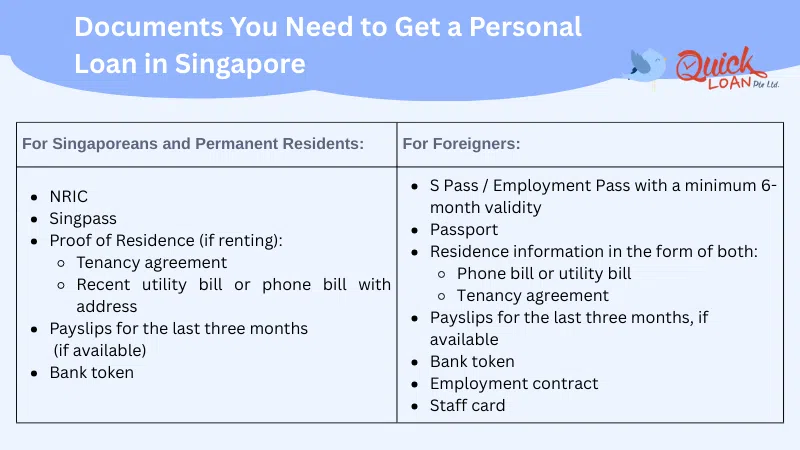

- Submit Your Documents

Provide us with basic documents such as:

For Singaporeans and Permanent Residents (PRs):

- NRIC

- Singpass login

- Proof of Residence (if renting):

- Tenancy agreement

- Recent utility bill or phone bill with address

- Payslips for the last three months (if available)

- Bank token

For Foreigners Working in Singapore:

- S Pass / Employment Pass with a minimum 6-month validity

- Passport

- Residence information in the form of both:

- Phone bill or utility bill

- Tenancy agreement

- Payslips for the last three months, if available

- Bank token

- Employment contract

- Staff card

- Receive a Fast Decision

We’ll process your application quickly. Unlike banks, we usually approve it within a few hours. For many clients, loans are disbursed on the same day.

- Review and Accept the Loan Offer

We’ll explain your loan details – interest rate, repayment amount, schedule, and fees. This way, you can make a smart choice. No pressure, no confusion.

- Receive Your Funds

Once you accept the offer, we’ll either transfer the funds to your account or give you cash in person. Choose the method that works best for you.

- Start Repayment Based on Your Chosen Plan

You’ll start repaying the loan next month. You can use your preferred method, like GIRO, bank transfer, or others. We also send reminders to help you stay on track.

Personal loans can help with urgent or large expenses, but use them wisely. Only borrow what you really need. Know all the costs involved. Make sure repayments fit easily into your budget.

Before deciding, it’s smart to look at your options and know the terms well. For a simple and clear lending experience, Quick Loan is ready to assist you. Contact us today for a complimentary, obligation free consultation! If you’re also planning to buy property soon, it’s worth understanding how taking a home loan after a personal loan might affect your borrowing power and approval chances.

Tips to Get Instant Approval on a Personal Loan

Getting the best interest rates at the lowest monthly repayments in a fast and secured way is what every personal loan borrower wishes for. This expectation need not be a dream though. You can get the best interest rates and monthly repayments with the following tips.

Choose a Licensed Moneylender

Licensed moneylenders employ technology to get things done fast. You can apply for a loan online, which moves the process faster, saving you time and efforts. When you need a personal loan for an urgent need, time is of essence and the faster the process, the better.

Loan approval is also faster with licensed moneylenders. You do not have to wait for days to know whether your loan has been approved or not. The process for loan application and approval takes only 30 minutes with a licensed moneylender in Singapore. You will receive your loan cash on the spot, upon approval.

Eligibility for loan qualification is more relaxed with licensed moneylenders in Singapore. The qualifying income range is wider and the rates of rejection are usually lower.

Your repayment capacity is the major criterion for moneylenders. Your application is less likely to be rejected if you qualify for repayment.

Loans from licensed moneylenders can be a life-saver when you are faced with crises such as accidents or medical emergencies. With their easy and flexible process, getting cash in hand within a day is not impossible.

Monitor your Credit Score

The key to getting instant loan approval is maintaining a healthy credit score. Avoid late payments, and consider keeping your credit low. Without proper credit monitoring, your debts can become unmanageable.

A good credit score also depends on your credit history, recent credits and the extent of your credit.

Plan your Finances Before Taking a Personal Loan

Be prepared with a budget beforehand to understand where you have to minimize expenses. With a plan, you will be better prepared to pay your monthly repayments. Delay or failure in monthly repayments can be prevented with a budget plan. You will also prevent the risk of going overboard with your expenses, which can lead to more debts.

A personal loan can bring several advantages to the table for anyone who is in the need of urgent cash and liquidity, and these can be used for a wide variety of applications, unlike other forms of specific loans. A personal loan can help you get out of tricky situations while helping you consolidate all your existing loans into a single unit as well. By lending from a licensed moneylender in Singapore, you can be assured that you will be getting the best deal there is, and the quick and simple approval and disbursal process would make the experience a breeze, so as to say.